If you need to cover periods of negative cash flow, set out how you plan to do this here. Give as much information as you can in the assumptions column to help the reader understand how you came up with your figures. Make sure you plan for annual increases to rates or travel costs. Summarise any assumptions you've made about your cash flowįor example, you might expect seasonal variations in sales or lower attendance during holiday periods. If you’re in the red at any point, you’ll need to describe your plans to cover these periods, for example through an overdraft facility with your bank.

This is the money you will have in the bank before you start. Add in your opening balance for month 1 in the yellow cell.Change the order of months in the second row if your financial year does not start in April.Enter the correct financial year in the top left cell.

CASH FLOW FORECAST TEMPLATE HOW TO

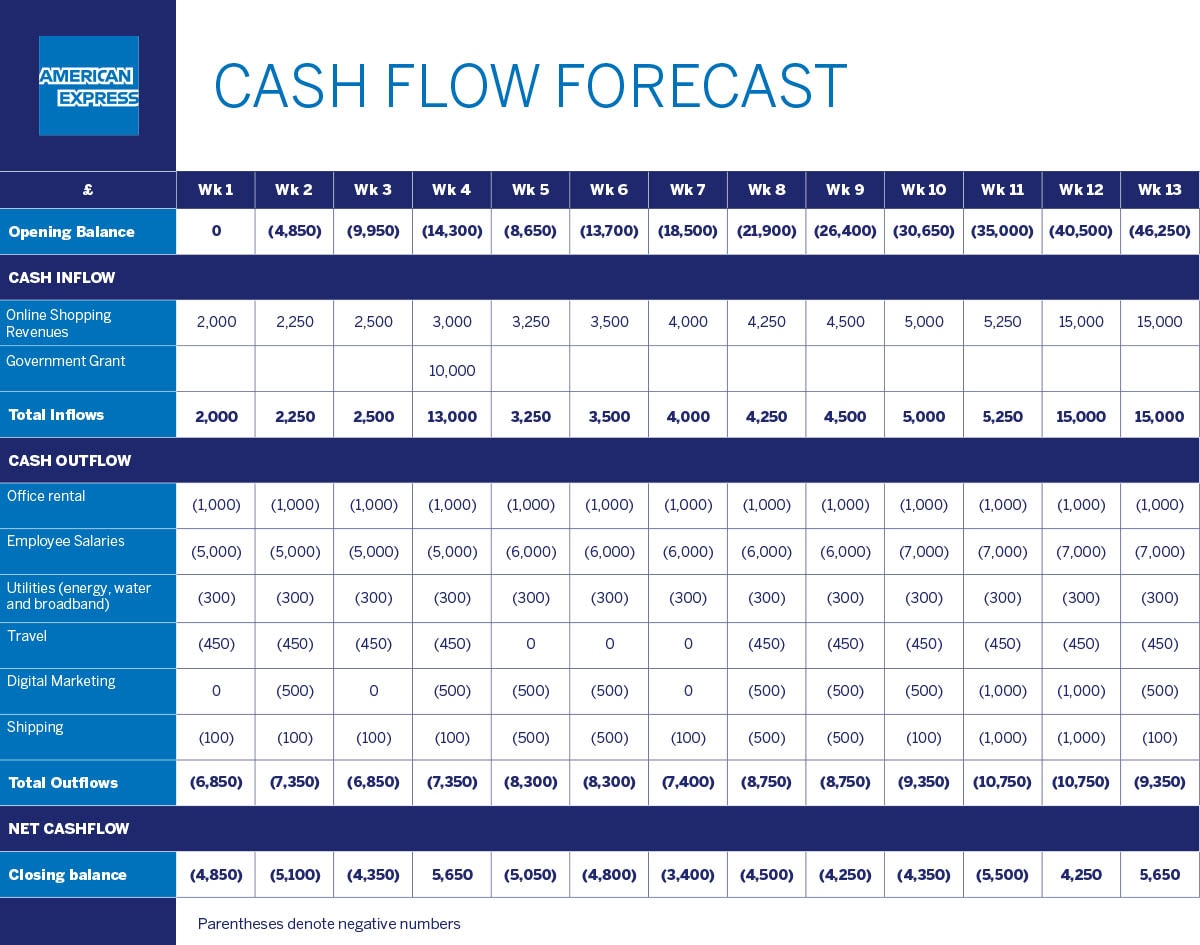

How to fill in the cash flow forecast template Complete the cash flow forecastįollow the instructions below to complete the cash flow forecast in the financial tables template. When you’re done, you can copy the table from Excel into your business plan. Make sure you prepare for delays in payments from clients – you might not receive payment in the same month that you issue an invoice. Review your suppliers regularly and ask for new quotes at least once a year. Find out if you can pay your bills by monthly Direct Debit, rather than in a lump sum. You can manage cash flow by finding ways to spread your costs. It will also tell you if and when you need to borrow money, for example through an overdraft facility or with a bridging loan. If you’re generating income from trading (sales), a cash flow forecast is vital to ensuring that you have enough money in the bank to cover your costs. You know how much you have, and you may have secured the income already.Ī cash flow forecast is a prediction of your income and expenditure over a specified period, usually 12 or 15 months. You would use this to manage a grant, for example. However, you may not be used to using a cash flow.Ī budget is how much you have to spend on particular items over a specified period. Most voluntary organisations will be used to managing a budget of some kind.

0 kommentar(er)

0 kommentar(er)